b&o tax rate

Algona 253 833-2897 000045 000045 000045 000045 10000 40000. B.

Explaining Our Analysis Of Washington State S Highly Regressive Tax Code Itep

For example if the retail sales tax rate is 000222 222 and the business has a taxable gross revenue amount of.

. The gross receipts BO tax is primarily measured on gross proceeds of sales or gross income for the reporting period. However these are not the same. Most businesses fall into the 110 of 1 rate including Retail.

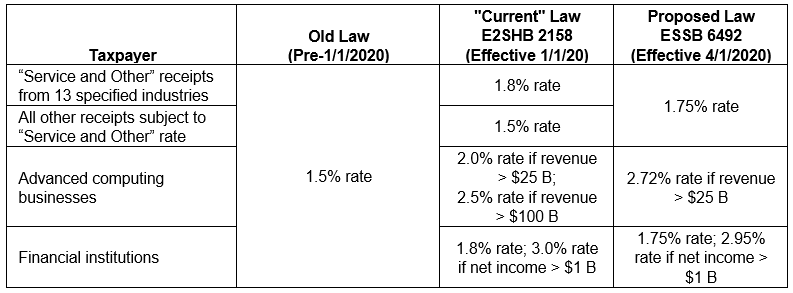

There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount to be determined by the application of the rate hereinafter set forth in this section against values or gross income of the taxpayer for the tax year. The additional tax is imposed at a rate of 12 of gross income taxable under the Service and Other Activities classification thus making the effective BO tax rate for these institutions 27. Marketplace facilitators such as Amazon typically collect sales tax at the retail sales rate which ranges from 7 to 105 depending on location and industry.

For more information please see the City of Renton Business and Occupation Tax Guide or Renton Municipal Code RMC. In addition retail sales tax must also be collected on all sales subject to the retailing classification of the BO tax unless a specific retail sales tax deduction or exemption applies. BO Tax is measured by the application of rates against values of products gross proceeds of sale or gross income of the business as the case may be.

All persons engaging in business activities in the City of Charleston are subject to the BO Tax unless specifically exempted by Chapter 110 Article II Section 110-63 of the Code of the City. If a taxpayer had taxable income of 1 million or more in the prior calendar year they will be subject to a 175 BO tax rate. The major classifications and tax rates are.

Washington unlike many other states does not have an income tax. Discover Helpful Information and Resources on Taxes From AARP. BO Tax Rates Classification Rate Manufacturing 00011 PrintingPublishing 000153 Processing For Hire Extracting for Hire 000153 Retailing 000153 Retail Service 0004 Service Other PrintingPublishing0004 Wholesaling 000102 Late Filing Penalties If a tax return is paid within one month following the due date the.

Washingtons BO tax is calculated on the gross income from activities. Auburn 253 876-1923 0001 0001 00015 00018 500000. The Retailing BO tax rate is 0471 percent 00471 of your gross receipts.

Although there are exemptions every person firm association or corporation doing business in. Service and Other Activities. How the tax works.

The state BO tax is a gross receipts tax. 9 rows All businesses are subject to the business and occupation BO tax unless specifically exempted. Your 2021 Tax Bracket to See Whats Been Adjusted.

Aberdeen 360 533-4100 0002 0003 e 00037 e 0003 e 5000 20000. You must file your Bellingham taxes separately from your state taxes. Effective April 1 2020 the BO tax will be imposed at two separate rates under the Service and Other Activities classification.

8 rows How much is the BO tax. Your gross revenue determines the amount of tax you pay. It is measured on the value of products gross proceeds of sales or gross income of the business.

The City of Bellevue collects certain taxes from businesses primarily the business and occupation B O tax which includes gross receipts and square footage taxes. Businesses with gross receipts of 15 million or more per year earned within the City of Renton will be required to file and pay BO tax. The nexus determination for sales tax is similar to the BO.

Local business occupation BO tax rates. If youre unsure how your business is classified the Department of Revenue provides a list of common business activities and their corresponding tax classification s. Both Washington and Tacomas BO tax are calculated on the gross income from activities.

Ad Compare Your 2022 Tax Bracket vs. Bellingham Municipal Code 604. 3 rows B O tax rates When paying the B O tax to the Department of Revenue you declare your.

Ad Answer Simple Questions About Your Life And We Do The Rest. Bellingham Municipal Code 605. Department of Revenue Taxes and Rates.

Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent. The current gross receipts tax rate of 01496 percent applies to all gross receipts tax classifications. Washington unlike many other states does not have an income tax.

It is measured on the value of products gross proceeds of sale or gross income of the business. BO TAX RATES Based on Gross Receipts Extracting 0017 Manufacturing 0017 Retailing 0017 Wholesaling 0017 Services and other activities 0044 BO TAX SCHEDULE Tax returns must be filed for each period even if no tax is due. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by.

The state does not exempt marketplace facilitators from collecting and remitting sales tax in addition to the BO tax. B O Tax. 100000 the business pays 222.

To calculate this amount multiply your taxable gross revenue amount by the tax rate. Similarly the city of Parkersburg divides businesses into 16 different categories for BO tax purposes with rates ranging from 015 per 100 gross receipts for wholesalers to 360 for electric power companies sales of electricity for domestic use and commercial lighting. The City Business Occupation BO tax is a gross receipts tax.

This means there are no deductions from the BO tax for labor. If a due date falls on. Businesses that are required to pay BO tax do not pay the Per Employee Fee.

Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Beginning with business activities occurring on or after January 1 2020 HB 2158 will impose an increase to BO tax surcharges for the Services and Other Activities classification increased rate from 15 to 18 for any person primarily engaged within Washington in any combination of over 40 enumerated activities.

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

Pdf Fiscal Forearms Taxation As The Lifeblood Of The Modern Liberal State

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

Drug And Alcohol Information Nights I 1183 And I 502 Updates Impacts And Strategies For Prevention Mary B Segawa M S Wa State Liquor Control Board Ppt Download

Corporate Tax In The United States Wikiwand

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

B O Tax For Auburn Businesses Here S What You Need To Know Auburn Examiner

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download